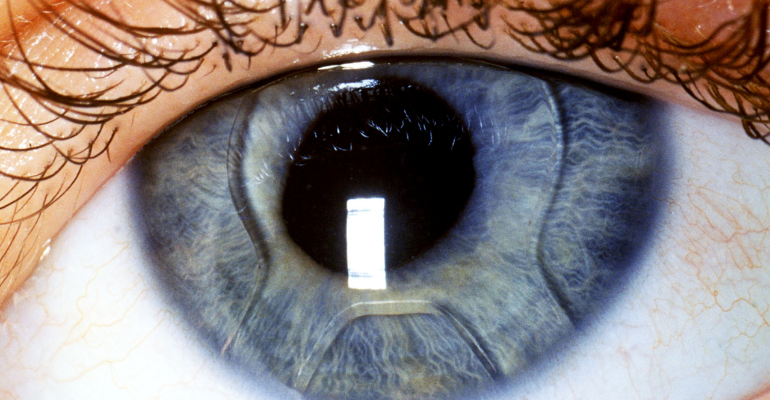

Johnson & Johnson has made a breakthrough for contact lens wearers with allergic eye itch by obtaining FDA approval for a drug-eluting contact lens. This development has caught the attention of medtech analysts at Needham & Co., who have released a report examining the contact lens market and the intraocular lens market, both of which show potential for growth.

According to Needham analysts David Saxon, Mike Matson, and Joseph Conway, both markets offer attractive opportunities due to their exposure to growth drivers that are somewhat insulated from pure volume growth. They believe that a shift towards premium products could increase the growth rate of each market beyond its historical mid-single digit rate.

The report also covers the coverage initiation of Alcon, Cooper Companies, RxSight, and STAAR Surgical by Needham & Co. analysts.

In terms of the contact lens market, the analysts note a shift towards premium lenses as a durable growth driver. This shift includes a move from monthly and two-week replacement lenses to daily lenses, which are priced significantly higher. There is also a transition from hydrogel to silicone hydrogel lenses, which come with an additional premium. Furthermore, improving the conversion rate from trialing to permanent wearer and increasing the retention rate among older wearers through multifocal contact lenses could contribute to market stability.

Staar Surgical recently obtained FDA approval for its EVO/EVO+ Visian Implantable Collamer Lens, which corrects myopia and myopia with astigmatism. This lens can be implanted in individuals with more severe refractive errors compared to laser-based procedures like Lasik.

Moving on to the intraocular lens (IOL) market, the analysts expect growth to be driven by premium lenses used in cataract surgeries. While monofocal IOLs currently dominate the market, toric and advanced technology IOLs have shown improvement in recent years. These premium lenses can be priced significantly higher than monofocal IOLs, presenting a potential tailwind for market growth.

The analysts also mention Google Trends analytics, which indicate that cataract procedure volumes are trending better than orthopedic and cardiovascular procedures, suggesting growth potential for the intraocular lens market.

According to the analysts, the current value of the intraocular lens market is approximately $3 billion.

In a separate report, the analysts highlight RxSight’s differentiated intraocular lens system, which includes a light adjustable lens (LAL) and a light delivery device (LDD). The LAL can be adjusted after the procedure to provide tailored visual correction, offering an advantage over other IOLs that require pre-operation decisions based on the patient’s visual preferences.

Alcon’s AcrySof IQ PanOptix Trifocal Intraocular Lens has surpassed one million implants worldwide. This multifocal IOL enhances near and intermediate vision in addition to clear distance vision after cataract removal. Alcon has also launched the Clareon family of IOLs in the United States, featuring advanced intraocular lens material with exceptional clarity and consistent visual outcomes.

Overall, the Needham & Co. analysts anticipate growth in both the contact lens and intraocular lens markets, driven by a shift towards premium products and advancements in technology.