Johnson & Johnson has made a significant breakthrough for contact lens wearers who suffer from allergic eye itch. The company recently obtained FDA approval for a drug-eluting contact lens, providing relief for those affected. Now, medtech analysts at Needham & Co. have released a report examining the contact lens market and the intraocular lens market, highlighting their potential for growth.

According to the analysts, both markets offer attractive opportunities due to their exposure to growth drivers that are somewhat insulated from pure volume growth. They believe that a shift towards premium products could increase the growth rate of both markets beyond their historical mid-single digit rate.

The report also covers the coverage initiation of Alcon, Cooper Companies, RxSight, and STAAR Surgical by Needham & Co. analysts. These companies are expected to play a significant role in the future of the medtech industry.

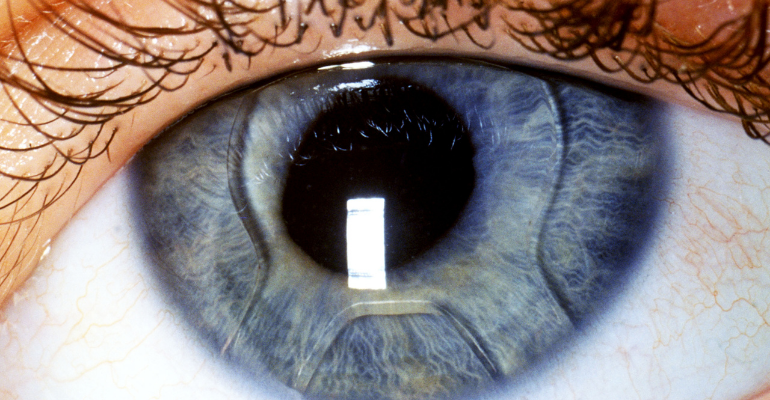

In terms of the contact lens market, the analysts note a shift towards premium lenses as a durable growth driver. This shift includes a move from monthly and two-week replacement lenses to daily lenses, which can be significantly more expensive. Additionally, there is a transition from hydrogel to silicone hydrogel lenses, which come with a premium price tag. The analysts also highlight the potential for increased market growth through improved conversion rates from trialing to permanent wearers and higher retention rates among older wearers due to advancements in multifocal contact lenses.

Staar Surgical has recently gained FDA approval for its EVO/EVO+ Visian Implantable Collamer Lens, designed to correct myopia and myopia with astigmatism. This lens offers a solution for individuals with more severe refractive errors compared to traditional laser-based procedures like Lasik.

Moving on to the intraocular lens (IOL) market, the analysts expect growth to be driven by premium lenses used in cataract surgeries. While monofocal IOLs currently dominate the market, toric and advanced technology IOLs have shown significant improvements in recent years. These premium lenses can be several times more expensive than monofocal IOLs, contributing to the anticipated mix shift towards higher-priced options.

The analysts also highlight Google Trends analytics as a potential indicator of growth in the intraocular lens market. According to their findings, cataract procedure volumes are trending better than orthopedic and cardiovascular procedures, suggesting a positive outlook for the market.

The report estimates the current value of the intraocular lens market at around $3 billion. It also highlights the unique features of RxSight’s light adjustable lens (LAL) system, which allows for post-procedure adjustments to provide tailored visual correction. This sets RxSight apart from other IOLs that require pre-operation decisions based on patient preferences, potentially leading to residual refractive errors.

Alcon, on the other hand, has achieved a significant milestone with its AcrySof IQ PanOptix Trifocal Intraocular Lens, surpassing one million implants worldwide. This multifocal IOL offers improved near and intermediate vision compared to monofocal lenses.

In March, Alcon also introduced the Clareon family of IOLs in the United States. These IOLs utilize advanced materials to deliver consistent visual outcomes and exceptional clarity, setting them apart from competitors.

Overall, the Needham & Co. report highlights the promising future of both the contact lens and intraocular lens markets. With a mix shift towards premium products and advancements in technology, these markets are poised for growth and offer exciting opportunities for medtech companies.